Building good credit starts with having an up-to-date budget that helps you make your payments on time and manage your money.

Building credit takes time, get started now.

Credit is built on trust, but if you don't know someone, how can you know if they are trustworthy? That's what credit scores are for; to provide a way for banks and credit unions to evaluate if a person seems to be financially trustworthy based on their record of financial performance & payment history. The better the financial performance & payment history, the higher the score.

Having good credit and being able to borrow money is part of

building financial security; and because helping people build financial security is our mission, we try to help people build good credit. Even if you never want to borrow, being able to borrow in case of unforeseen circumstances provides financial options that you may need some day. By creating a budget now, you are starting to prepare for that someday event that may require you to use all of your financial options.

Credit Building Opportunities

Relationships Matter to

Credit Unions

You're not a number, so we won't treat you like one. That includes when we make credit decisions. We want to know you, your story, your situation, and how we can work with your situation to get you to a better place financially. Yes, we consider your credit score, but that isn't the only consideration.

Secured & Unsecured

Credit Cards:

Credit cards can be powerful financial tools, or doorways to long-term debt, depending on how they are managed. Secured credit cards help people learn to manage credit while keeping the door to debt closed. They are great for learning to manage credit until someone is ready to handle the risk of debt responsibly.

Secured & Unsecured

Lending:

Having a paid off loan on your credit makes getting approved for other loans a lot easier. With a little planning you can get a 'Credit Builder' loan paid off before you buy a car and get your cash back to use as a down payment. After you have shown you will pay on time you are more likely to qualify for a car loan.

We are ready to answer your questions about building credit.

Managing & Reducing Debt

One of the funny things about building credit is that you need to have some debt to show that you can make payments on time; but if you have too much debt, or no debt at all, it reflects negatively on you.

If you have debt, you have manage it. If you are not going to manage your debt you are fighting against yourself, you cannot have both good credit and unmanaged debt.

The key to building credit as it relates to debt, is to have the right kinds of debt and the right amount for your income. A financial counselor or a loan officer at a local credit union can help you get specific on what kinds and amounts are of debt will help increase your credit score the most.

If you are having a hard time making your payments, the answer isn't trying to build better credit, the answer is managing your debts better and starting to pay them off. Then when you are able to make all your payments and have something left over you can think about optimizing your debt mix to improve your credit.

If you need help paying off your debts, your first step is to create a detailed budget, which you can start working on here. If, after your budget is built, you can see that there just isn't enough money coming in to cover all the debt payments going out, it may be time to consider debt consolidation. Talk to a financial counselor or loan officer to discuss the details on how debt consolidation loans work and if one is right for you and your situation.

To learn more about how your credit score is calculated and how technology can help you manager your money check out our credit technology page.

Preparing for a major purchase:

Unless you have an emergency situation where you absolutely Must make a major purchase right away, or you can afford to pay cash for your purchase, taking a little time to clean up your credit before shopping for a car, house, or other major purchase is almost always the best way to go. Here's why:

Your credit score has a big impact on your interest rate, and your interest rate has a big impact on your monthly payment. By cleaning up and/or building your credit you can get a more affordable payment that fits into your budget and still leaves you money for other things in life.

The first thing to do is do get a copy of your credit report, and make sure that everything on it is accurate. If it's not, there are steps you can take to dispute incorrect information. The dispute process can take a while so reviewing your credit early on is important. If your credit report is accurate, looking for ways to improve your credit quickly is your next step. Quick changes, like those discussed in the linked article, won't undue years of bad payments, but if you have made your payments on time and still have a low score there are probably some things you can do to improve your score over a couple months. Much of this you can do on your own, but if you want help, we are glad to do what we can to get you ready for your next major purchase. Email budget@accesscu.net if you would like to talk with someone.

Avoid payday & car-title loans.

If you have had credit problems before or you don't have any credit history, using payday lenders may seem like your only option when an unexpected expense comes up, but it's not. In fact, using a payday or car-title lender is much more likely to hurt your credit, plus you are very likely to end up paying much more in fees & interest than with other forms of lending.

Here's why... Unlike bank or credit unions, most payday lenders structure their loans so that you have to make payments more frequently and there are often separate finance charges, transaction charges, or processing fees for each payment instead of just paying those fees once per month. This can take money out of your pocket every week or every other week which makes it harder to pay your regular monthly bills because you don't get the opportunity to save up a paycheck or two to pay off a whole bill. This often leads to late fees and penalties on your bills, which takes more money out of your pocket.

People get stuck in a back & forth between paying their bills or paying their loans, until you miss a loan payment, then you get penalty interest and more fees, which they offer to finance for you as long as you roll it all into a new loan. Now you owe more than before, but you didn't get any more money from them; and you are stuck in their system of never-ending debt.

Here are some financial products & services that may give you options without putting you into financial hardship.

Don't fall for the guaranteed credit scam:

If a lender is not pulling your credit and basing their loan decision on your credit report, what they are offering you is less like the traditional credit you want that builds your score; and more of a bet that they can get you stuck in their system before you can pay the loan back. Some payday & car-title lenders don't even report on-time payments to the credit agencies - but they will definitely report it when you are late or stop making payments.

If a lender or finance company offers you immediate credit or guaranteed credit, you can guarantee that you are going to pay way too much to borrow from them; and it will probably ruin your real credit.

Many people end up paying hundreds or even thousands of percent in interest over the course of a loan and end up paying more than 10 times as much for the same money they could have borrowed from a local credit union. Before you take the bait call a local credit union and explore your options.

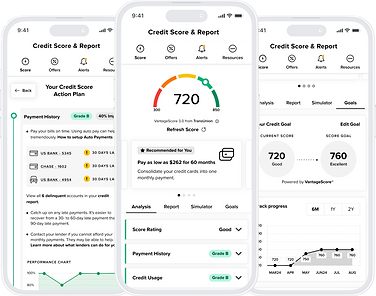

Credit Technology

Using the right tech makes it easier to get your spending on track and build your credit score. Ask about getting free access to credit building and credit managment tools available via online & mobile banking platforms.

Get best-in-class financial tech plus amazing personal service.

Track spending by category, by vendor, or custom characteristics

Manage multiple cards a with independent controls for each card

Use custom card restrictions to prevent unwanted of spending